Adam Leishman is the Principal Licensee and Director of The Commercial Guys and operates from a position very few commercial agents can genuinely claim.

Before entering agency, Adam built his career as a commercial property owner and lessor.

That owner-side experience fundamentally shapes how he advises clients today.

This means decisions are made through the lens of asset performance, risk, structure and long-term value, not just transaction speed.

Adam’s point of difference is not simply experience. It is the combination of ownership, legal structuring knowledge and operational governance inside a commercial agency environment.

In addition to his agency background, Adam has been directly involved in the establishment and structuring of a specialist commercial property law firm. Through this work, and through his own long-term ownership and development activity, he has developed deep capability in commercial property legal and ownership structures.

This includes:

-

body corporate and layered scheme arrangements

-

principal and subsidiary scheme structures

-

complex mixed-use and multi-stakeholder ownership frameworks

-

staged and development-led commercial projects

This rare crossover between agency practice and commercial property law structuring allows Adam to identify risk earlier, structure transactions more effectively, and avoid costly mistakes that commonly arise when legal and commercial considerations are handled in isolation.

For owners and investors, this translates into:

better project design, cleaner deal structures, smoother delivery, stronger compliance outcomes and materially reduced friction during transactions and development.

At The Commercial Guys, Adam leads the firm’s operational, governance and compliance framework, ensuring that the business operates to consistently high professional and regulatory standards.

His responsibilities include:

-

Sales and leasing administration

-

Trust account governance (separate trust accounts for sales and leasing, and for property management)

-

Asset management oversight

-

Budgeting, financial analysis and forecasting

-

Licensing, regulatory and governance compliance

This internal focus allows the client-facing team to move faster and with greater confidence, while maintaining strong risk management and compliance discipline across every transaction.

Industry leadership, capability and professional standing

-

Licensed Commercial Real Estate Agent

-

Justice of the Peace (Qualified)

-

Previous member, Real Estate Institute of Queensland – Commercial and Industrial Chapter Committee

-

Active contributor to industry knowledge, operational frameworks and best-practice standards within the commercial property sector

Adam is particularly focused on lifting industry standards around governance, compliance, systems design and asset lifecycle management, and regularly supports the development of internal and external best-practice frameworks.

View Adam’s other experience and background here:

Mastering disruption and building a future-ready agency

Adam’s leadership philosophy and the evolution of The Commercial Guys are outlined in the video:

“Mastering disruption – How The Commercial Guys have built a future-proof commercial property agency.”

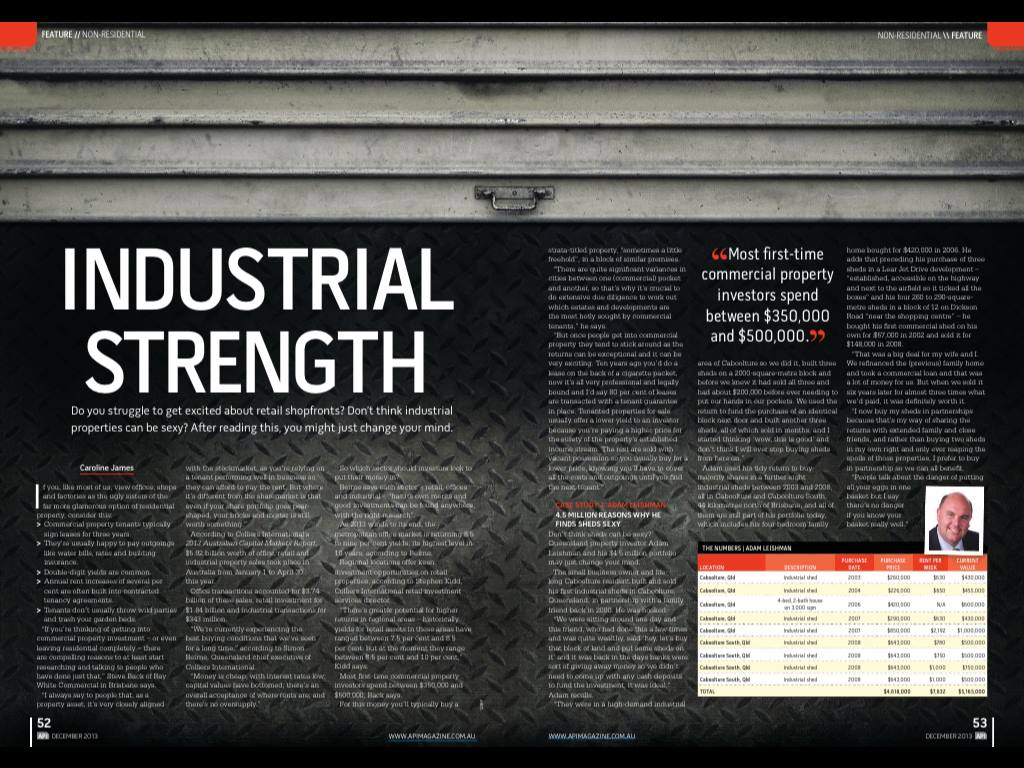

Adam has been featured in a number of industry publications and interviews in relation to commercial property strategy and a complete asset lifecycle approach, spanning acquisition, development, repositioning, leasing, active management and exit planning.

Unlike a typical agent profile, you will not find a long list of public-facing listings under Adam’s name.

The majority of Adam’s work is delivered behind the scenes, supporting property owners and investors through asset repositioning, complex transactions, development projects and high-level asset management strategies that rarely reach the open market.

A significant portion of his work is conducted off-market, where discretion, structuring capability and tailored commercial solutions are essential.

This model allows Adam to focus on outcomes rather than volume, and to create long-term value for owners and investors where structure, timing and strategy matter more than exposure.